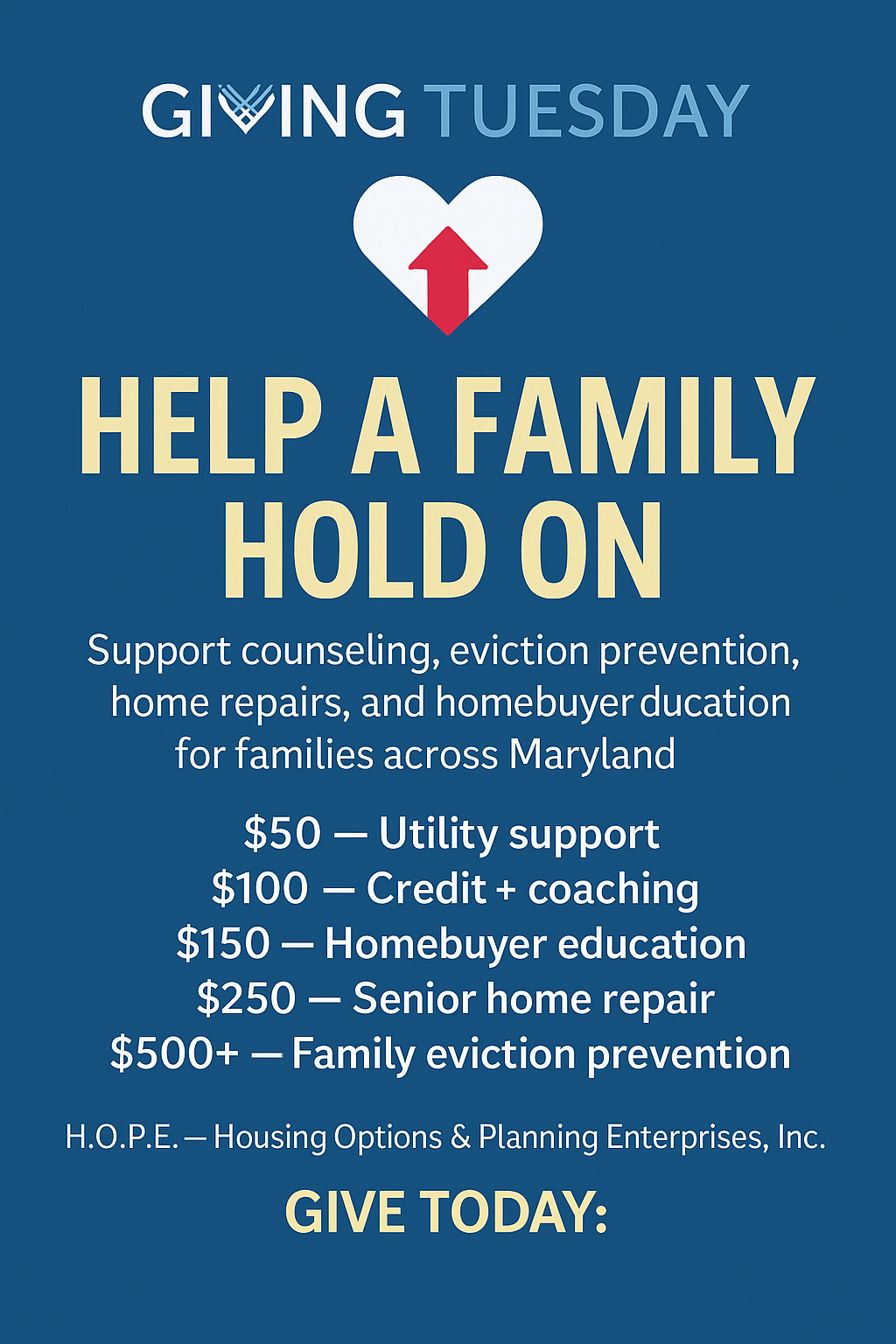

✨ “Help a Family Hold On” with your donation!✨

Help a Family Hold On: Giving Tuesday 2025

Meet Ms. Jackson. A 68-year-old homeowner living in Prince George’s County, Ms. Jackson was at risk of losing her home due to medical bills and overdue utilities. H.O.P.E. stepped in with financial counseling, utility assistance navigation, and a home repair referral. Today, she is safe, stable, and still in the home she has loved for 30 years.

Your donation makes stories like hers possibleThis Giving Tuesday, H.O.P.E. is launching “Help a Family Hold On,” a campaign focused on strengthening housing stability for low- to moderate-income families who are fighting to keep a roof over their heads.

Across our region, hundreds of households are facing rising rents, utility shutoffs, aging homes, and shrinking savings. Many are seniors living on fixed incomes. Others are parents working hard yet still falling behind. For these households, H.O.P.E. is the lifeline—and your gift makes that possible.

Your support helps families avoid eviction, navigate mortgage challenges, repair unsafe homes, build credit, complete homebuyer education, and access vital financial counseling. With your help, we can keep more families housed, stable, and hopeful this holiday season.

Together, we can make sure no family falls through the cracks.